How to Calculate Dividend Per Share

Lets suppose Heromotos PE ratio has been 1853 in the past 2465 divided by 14839 166 times the current PE ratio. Dividend per share DPS is the sum of declared dividends issued by a company for every ordinary share outstanding.

Dividend Per Share Business Tutor2u

Suppose company ABCs stock is trading at 20 and pays yearly dividends of 1 per share to its shareholders.

. Annual Dividends per share. The amount that will be invested initially. This represents the amount of dividend money that investors are awarded for each share of company stock they own.

Kinder Morgan Incs NYSE. EPS is easily calculated from basic financial information you can find online. The amount that will be additionally invested per year.

DPS is an important metric to investors because the amount a firm pays out in dividends directly translates to income for the shareholder and the DPS is one. Calculating the dividend per share allows an investor to determine how much income from the company he or she will receive on a per-share basis. The company is reporting second quarter net.

Read more and Price per Share. Read more PriceEarnings ratio and basic EPS. Dividend Per Share DPS is the total amount of dividends attributed to each individual share outstanding of a company.

What Dividends Per Share Tells You. Dividend yield 350 50. You need to provide the two inputs of Dividend per Share Dividend Per Share Dividends per share are calculated by dividing the total amount of dividends paid out by the company over a year by the total number of average shares held.

It is very simple. Reality Income pays a dividend of 283 per share. Company ABCs dividend yield is 5 1 20 while XYZs dividend yield is only 25 1 40.

Monthly dividend calculator dividend calculator monthly dividend income calculator monthly dividend yield calculator quarterly dividend calculator dividend. KMI board of directors today approved a cash dividend of 02775 per share for the second quarter 111 annualized payable on August 15 2022 to stockholders of record as of the close of business on August 1 2022. Dividends are usually a cash payment paid to the investors in a company although there are.

Dividend Per Share - DPS. This may seem complicated however thats exactly why we created this stock dividend calculator. The present stock price should be 18 times.

However it would help if you also looked at other financial ratios like return on total assets ROCE ROCE Return on Capital Employed ROCE is a metric that analyses how effectively a company uses its capital and as a result indicates long. Last 12-months earnings per share. Easy to use dividend calculator.

Calculate dividend yield total income per month quarterly or yearly based on the number of shares you own and total cost to acquire this yield. Dividend per share DPS is the total dividends paid. Assuming all other factors are.

Additionally the Companys Board of Directors declared a cash dividend of 021 per share of Class A and Class B Common Stock to be paid on September 12 2022 to all shareholders of record as. Estimate the dividend and growth yield of your investment with a few clicks. How to calculate your weighted average price per share When it comes to buying stock a weighted average price can be used when shares of the same stock are acquired in multiple transactions over.

First calculate dividend yield using the formula Dividend yield annual dividend stock price 100 If a share price is 50 and the annual dividend is 350 dividend yield is calculated using the formula. For a given time period DPS can be calculated using the formula DPS D - SDS where D the amount of money paid in. This dividend is a 3 increase over the second quarter of 2021.

Dividend Yield Annual Dividends Paid Per Share Price Per Share For example if a company paid out 5 in dividends per share and its shares currently cost 150 its dividend yield would be 333. Calculate Dividend Yield in Excel. Determine the dividends paid per share of company stock.

Also suppose that company XYZs stock is trading at 40 and also pays annual dividends of 1 per share. Estimate the dividend and growth yield of your investment with a few clicks. Find your companys dividends per share or DPS value.

EPS tells you a lot about a company including a companys current and future profitability. Earnings per share EPS is the portion of a companys net income that would be earned per share if all profits were paid out to shareholders. It is calculated as the proportion of the current price per share to the earnings per share.

Book Value per Share.

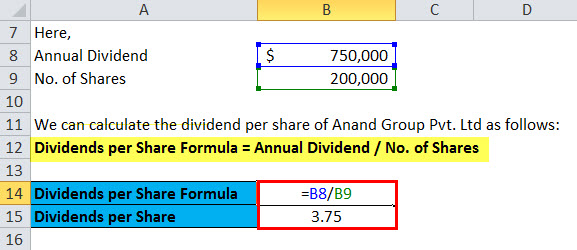

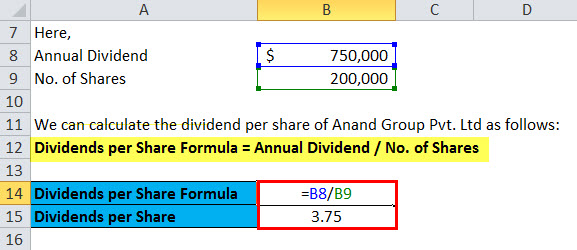

Dividends Per Share Formula Calculator Excel Template

Dividend Definition And Examples Of Dividend Stocks

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Dps Formula And Calculator Excel Template

Comments

Post a Comment